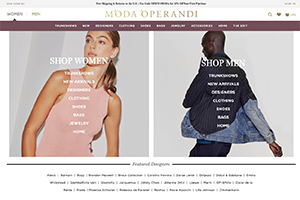

Moda Operandi

Moda Operandi is the only online retailer to invite clients to pre-order next-season’s looks straight from the runway. And for those who can’t wait, there is the expertly curated in-season boutique.

Moda Operandi is the only online retailer to invite clients to pre-order next-season’s looks straight from the runway. And for those who can’t wait, there is the expertly curated in-season boutique.

Zeel delivers Massage On Demand® by providing top-quality massages from licensed, vetted massage therapists in homes, hotels, workplaces, and at events with as little as an hour’s notice.

PineLabs is an India-based spinout of Globallogic, another NAV portfolio company. It is a payment and loyalty solutions company targeting its products and services to Indian retailers that want to automate their operations while offering better services to consumers. Pine Labs started in the oil retail business by enabling electronic automation of transactions at gas stations. From there, it has expanded to offering solutions for retailers to keep more of their customers’ business. As India is maturing and growing, retail innovation will require modern solutions like PineLabs. PineLabs differentiates itself among many other players by offering solutions that can be customized for the idiosyncracies of the Indian market.

Provides a B2B payment intermediary for making domestic and international payments. The Company offers software and services used by corporate treasury, finance, and accounts payable departments to process and execute domestic and international payments.

March 2000

Acquired by GoTo.com for $175 million

A native Grecian, Thanasis has an innate ability to spot trends early and accurately predict how they will be adopted globally. He has invested in entrepreneurs whose technology brought text messaging mainstream in the United States, movies to the Web, radio to your phone and the ability to buy couture straight from the runway. Thanasis brings two decades of experience to his entrepreneurial teams and access to to a premier set of syndicate investors as companies quickly scale. Before he became a venture capitalist, he spent three years providing corporate restructuring and financial strategies for 20 public subsidiaries and early-stage technology opportunities that are now part of Thermo Fisher Scientific. He started his career at McKinsey & Co.